CFO Outsourcing for Companies in China

A Chief Financial Officer (CFO) is crucial, while the hiring cost is significant. That’s when Dingxin’s CFO outsourcing service is just right for you!

It is well recognized that an experienced Chief Financial Officer (CFO) is absolutely an essential part for the operations of all companies. Responsible for conducting financial planning, defining taxation strategies, managing internal control, and legal compliance, and sometimes making investment decisions and managing the capital structure, a qualified CFO always plays an important role that should never be ignored.

For most startups, as well as medium- and small-size companies, how to find a senior financial manager can be challenging, not to mention the financial burden of recruiting an in-house CFO. That is why Dingxin’s CFO Outsource service is just right for you and your company in China! You will enjoy financial management performance as outstanding as a full-time CFO can provide, at the cost of a part-time senior financial specialist! We will also assist you in building a comprehensive financial management framework to drive your operation and business to greater success!

Experienced CFOs of international enterprises who handle cross-border investments have a good understanding of how to apply International Financial Reporting Standards (IFRS) to manage Chinese accounting. They are adept at seamlessly integrating local financial software data into the enterprise's internal financial systems.

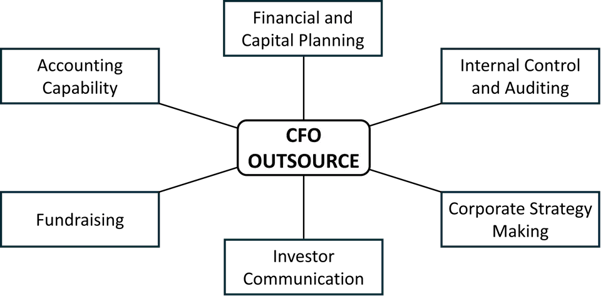

What Does A CFO Outsource Service Include?

Nowadays, a company’s decision-making largely relies on data and the potential information it contains. Helping your company extract valuable insights from financial data is the crucial factor of Dingxin’s CFO outsource services, simplifying the strategy planning process from ‘essay questions’ to multiple-choice questions, and shifting your business in China from ‘intuitive thinking’ to ‘data-driven thinking’.

Differences between Bookkeeping and CFO Outsourcing?

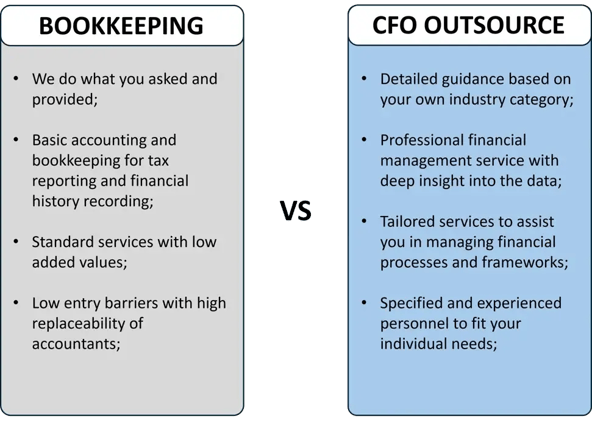

Traditional bookkeeping services focus on the essential daily financial history and tax reporting, where the transactions of your company are recorded. These services can be standard as the processes and requirements are much similar.

CFO outsourcing, on the other hand, emphasizes the importance of financial management and planning in advance, designed to manage the more complex financial aspects of your company. A well-established financial management framework can support and back your company’s strategic decision-making, providing customized solutions with deep insights into the operations of your company in China.

Why Your Company Should Consider CFO Outsourcing?

Considering the importance of CFO to your business operation in China, there are many reasons to choose CFO outsourcing services:

- Cost and time-effective: choosing CFO outsourcing can help your company achieve the responsibilities of a full-time accountant at the cost of a part-time position. At the same time, as you may not be a professional financial specialist yourself, finding it hard to fully understand the complex terms, especially during the startup stages. CFO

- Outsourcing can deliver financial statements that are comprehensible to business owners, ensuring effective communication from a management perspective.

- More than just accountants: we don’t just outsource a senior financial manager; we provide a service that suits your own financial needs. A replacement is always prepared in case of a sudden departure, so a qualified professional is guaranteed to avoid any inconsistency in your daily management.

- Tailored financial solutions: we complete all financial tasks based on the foundational business operations of your company and engage in in-depth monthly discussions with business owners. This ensures they have a clear and accurate understanding of their financial data and accounting information.

- Strategic financial insight: We delve into the fundamental operations of your company to provide strategic advice. When problems arise, we offer professional suggestions promptly. Business owners facing financial issues can immediately clarify these with our accountants, ensuring timely and effective solutions.

- Confidentiality commitment: As a service provider, we can sign confidentiality agreements with businesses to ensure that all operational and financial data remain strictly confidential.

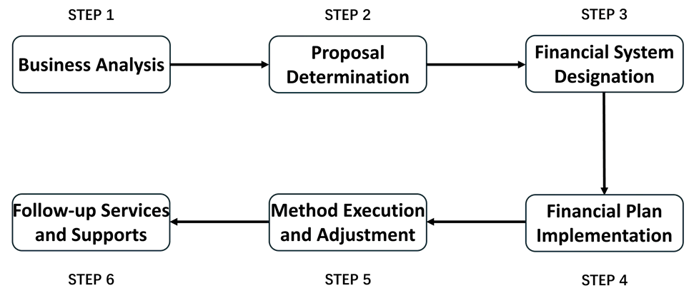

The Workflow of Dingxin’s CFO Outsourcing Services

Our team of professional accountants, tax, and payroll personnel provides effective outsourcing services for your individual business operation in China. We fully understand that to maximize the company value of our clients, it is crucial for you to focus limited operational resources on core business activities. Our experienced outsourcing consultants enhance this process by reviewing business workflows and constructing business improvement systems for your own requirements. The distinctive features of our specialized services include:

- Strict After-sales Quality Control: All our outsourced personnel need to undergo strict training specific to their positions, job content, and responsibilities.

- Transition Management: A backup financial manager is always ready in case of a position transition. They will be assigned for the management of your company one month in advance of any changes, ensuring that your company will not be affected.

- Tailored Services: We will select the most suitable financial management software and systems for you and produce high-quality financial reports tailored to your business circumstances. Additionally, we offer multilingual services to meet your needs, including English, Mandarin, and Cantonese.

- High-Quality One-Stop Service: Our service team comprises professionals from diverse backgrounds who are closely related to your company’s financial management, including CPAs, tax consultants, and lawyers. They will collaborate to strategize for your company's management so you don’t have to repeatedly communicate with different consultants, which will significantly save you time and energy.

- Flexible Management: Whether your company in China is just a startup or has grown into a large publicly-listed entity, we will provide personalized, flexible solutions tailored to your company’s size and specific needs.

Frequently Asked Questions

Still have a question? No worries! We are glad to answer!

Which types of companies are suitable for CFO outsourcing?

CFO outsourcing is suitable for various types of companies, especially:

- Small and medium-sized enterprises (SMEs) and startups: These companies may not have the budget to hire a full-time CFO.

- Companies needing financial expertise: If a company lacks internal financial management capabilities but requires high-level financial strategy support.

- Multinational companies: Foreign companies needing professional financial management support in China.

- Companies with specific project needs: For example, financial audits, budgeting, mergers and acquisitions, or financing needs.

How are the fees for CFO outsourcing calculated?

CFO outsourcing fees are typically calculated in the following ways:

- Hourly rate: Fees are based on the hourly rates set by the CFO outsourcing provider.

- Project-based fee: Charging for specific projects, such as financial audits or budget creation.

- Fixed monthly fee: A fixed fee is paid monthly, based on the company’s needs and the scope of services.

- Fee based on company size or financial complexity: Some providers charge according to the company's size or the complexity of its financial needs.

The most suitable method will be determined based on your specific needs and company size. You can further communicate with Dingxin, and we will provide you with a more detailed plan.

Can CFO outsourcing meet the needs of companies of different sizes?

Yes, CFO outsourcing services can be tailored to meet the needs of companies of all sizes. Whether it’s a small business or a large multinational company, outsourced CFOs can offer customized services to address the company’s specific financial challenges.

Does CFO outsourcing affect a company's financial independence and control?

Generally, CFO outsourcing does not affect a company’s financial independence or control. The outsourced CFO still works in alignment with the company's senior management and strategy, and the company retains final control over financial decisions. The role of the outsourced CFO is to provide support and advice, rather than make decisions on behalf of the company.

Please give us a message

Tel:15066768857

E-mail:sales@dxjclegalconsulting.com